Customer Acquisition Cost sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

Understanding the ins and outs of Customer Acquisition Cost is crucial for businesses aiming to boost their growth and reach new heights in the competitive market landscape. From calculating CAC to optimizing strategies, this topic delves into the core principles that drive success in customer acquisition.

Introduction to Customer Acquisition Cost (CAC)

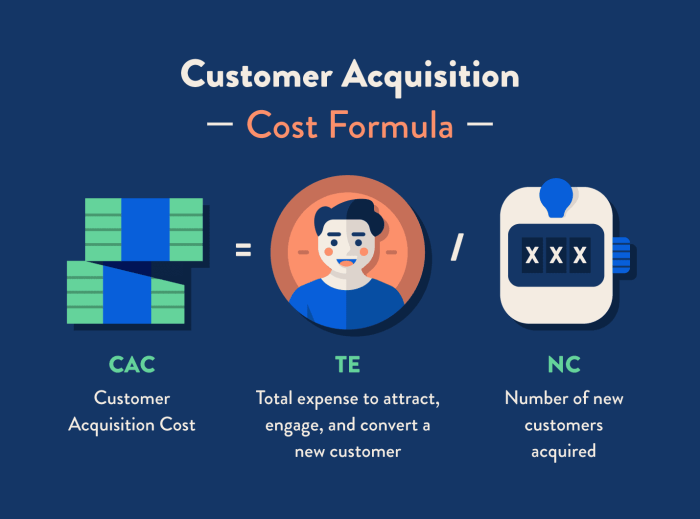

Customer Acquisition Cost (CAC) is the total cost a business incurs to acquire a new customer. This includes all marketing and sales expenses needed to convince a potential customer to make a purchase. Calculating CAC is crucial for businesses to understand how much they are spending to acquire customers and to evaluate the effectiveness of their marketing strategies.

Importance of CAC for Businesses

- Helps businesses determine the profitability of acquiring new customers.

- Allows businesses to allocate resources effectively by identifying the most cost-effective marketing channels.

- Enables businesses to set appropriate pricing strategies based on customer acquisition costs.

Calculation of CAC in Different Industries

- In the Software as a Service (SaaS) industry, CAC is calculated by dividing the total sales and marketing expenses by the number of new customers acquired within a specific period.

- In the E-commerce industry, CAC can be calculated by dividing the total marketing and advertising costs by the number of new customers gained through those efforts.

- In the Retail industry, CAC is calculated by dividing the total marketing and sales expenses by the number of new customers acquired through promotional campaigns or loyalty programs.

Factors Affecting Customer Acquisition Cost

Customer Acquisition Cost (CAC) is influenced by several key factors that play a crucial role in determining the overall cost of acquiring new customers. These factors include competition, marketing channels, and various internal and external elements that impact the efficiency of the acquisition process.

Competition Impact on CAC, Customer Acquisition Cost

Competition in the market directly affects the Customer Acquisition Cost. In highly competitive industries, businesses often need to invest more resources in marketing and advertising to stand out and attract customers. This increased competition can drive up the cost of acquiring customers as companies strive to outbid each other for the same target audience.

Role of Marketing Channels in Determining CAC

The choice of marketing channels can significantly impact the Customer Acquisition Cost. Different channels have varying costs associated with them, and their effectiveness in reaching and converting potential customers also varies. Businesses need to carefully analyze and optimize their marketing channels to ensure maximum return on investment and minimize CAC. For example, digital marketing channels like social media advertising may have lower costs compared to traditional print advertising, but their effectiveness in reaching the target audience can differ based on the industry and customer demographics.

Strategies to Optimize Customer Acquisition Cost

In order to reduce Customer Acquisition Cost (CAC) and maximize profitability, companies must implement strategic techniques to attract and retain customers efficiently.

Techniques to Reduce CAC

- Utilize targeted marketing campaigns to reach the right audience and avoid wasted resources.

- Optimize conversion rates by improving website design, landing pages, and user experience.

- Implement referral programs to incentivize existing customers to bring in new business.

- Utilize social media and content marketing to engage with potential customers at a lower cost.

- Utilize data analytics to track and optimize the customer journey, identifying areas for improvement.

Importance of Customer Retention in Lowering CAC

- Repeat customers are more cost-effective to retain than acquiring new ones, as they require less marketing spend.

- Building strong relationships with existing customers can lead to word-of-mouth referrals, reducing the need for costly acquisition strategies.

- Offering excellent customer service and personalized experiences can increase customer loyalty and retention rates.

Concept of CAC Payback Period

The CAC payback period refers to the amount of time it takes for a company to recoup the cost of acquiring a new customer. This metric is crucial for evaluating the efficiency of marketing and sales strategies. A shorter payback period indicates that the company is generating revenue from customers more quickly, leading to a more sustainable business model.

Calculating and Analyzing Customer Acquisition Cost

Customer Acquisition Cost (CAC) is a crucial metric for businesses to understand how much it costs to acquire a new customer. Calculating and analyzing CAC helps companies make informed decisions about their marketing strategies and budget allocation.

Step-by-Step Guide on Calculating CAC

To calculate CAC, follow these steps:

- Determine the total costs associated with acquiring customers, including marketing expenses, sales team salaries, and any other costs directly related to customer acquisition.

- Choose a specific time period, such as a month or a quarter, to focus on for the calculations.

- Divide the total costs by the number of customers acquired during that time period to get the CAC.

Significance of CAC to Customer Lifetime Value (CLV)

Customer Lifetime Value (CLV) represents the total revenue a customer is expected to generate over their entire relationship with a company. Understanding CAC in relation to CLV is crucial for determining the profitability of acquiring customers. A lower CAC compared to CLV indicates a healthy return on investment and long-term customer value.

Comparing Different Methods of Analyzing CAC Effectiveness

There are various methods to analyze the effectiveness of CAC, including:

- Comparing CAC across different marketing channels to identify the most cost-effective channels.

- Calculating CAC by customer segments to understand which types of customers are more profitable.

- Monitoring CAC trends over time to assess the impact of marketing campaigns and strategies.